Algorand was built for institutional performance. Now it has the stablecoin infrastructure to match.

Brale now supports Algorand.

Enterprises, fintechs, and payment platforms can create and manage fiat-backed stablecoins on Algorand using Brale's regulated infrastructure and unified API. Everything from custody to compliance tooling is built in:

Algorand's low cost, instant finality, and native compliance features like freeze and clawback make it ideal for enterprise-scale financial applications. Brale adds the infrastructure to issue regulated stablecoins combined with licensed money movement, fiat connectivity, and potential revenue share from day one.

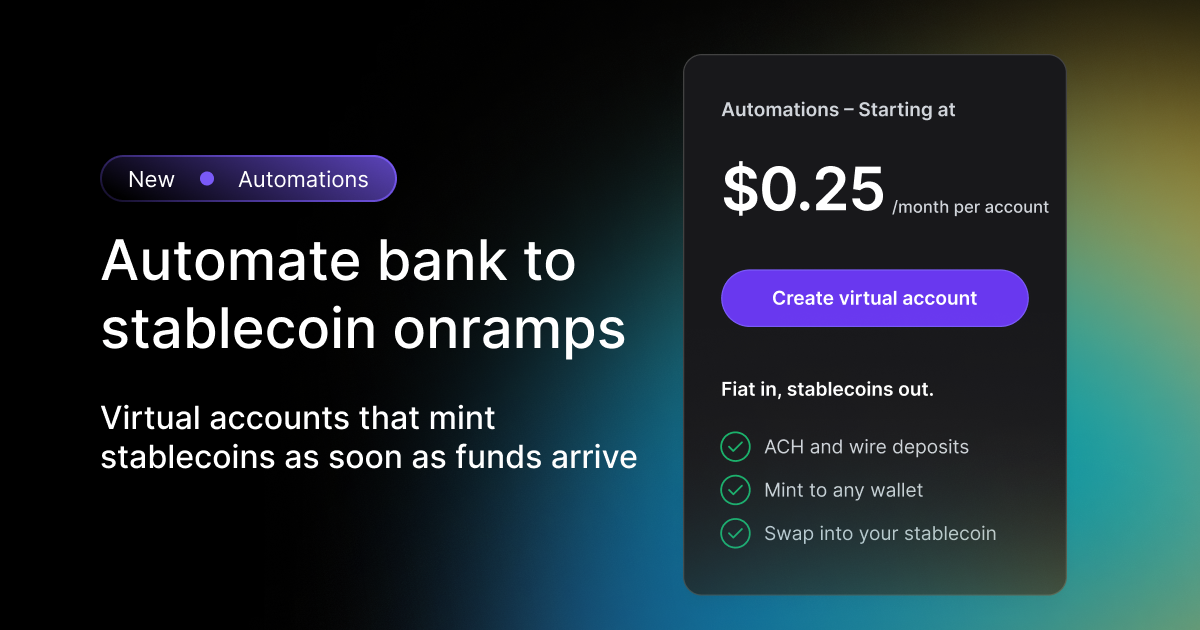

For builders, this unlocks new payment and treasury rails:

- Remittances

- Cross-border payouts

- Multi-currency wallets

- Embedded finance and treasury infrastructure

Issue native stablecoins on Algorand

Issue regulated stablecoins on Algorand in minutes and take advantage of integrated on and off-ramps, treasury management, and transparent reserves.

If you are already using the Brale API, Algorand is now an option starting today, no new integration required.

Talk to our team to issue your stablecoin and start building on Algorand